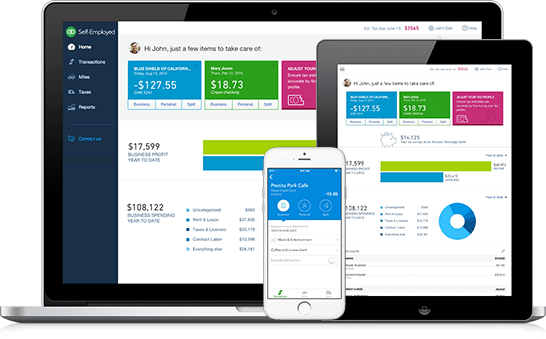

QuickBooks is renowned in the business world and now the are introducing a new solution to assist keep accounts in order in the form of QuickBooks Self Employed.

Designed for contractors, freelancers, and the self-employed, you can now manage your deductions and more with QuickBooks Self Employed.

QuickBooks Self Employed connects to your bank so you can easily categorise income and expenses, capture and match receipts, send invoices, and automatically track mileage so you will be ready come tax time.

QuickBooks Self Employed Offers:

- Effortless invoicing – Create and send professional invoices quickly on the go. Get paid faster by enabling online payments.

- Track mileage automatically – Automatic mileage tracking means automatic deduction tracking- an average of $7393 in potential mileage deductions per year.

- Point, snap, store – A quick picture is all it takes to keep every receipt at your fingertips so you don’t have to worry about losing them.

- Easy quarterly taxes – QuickBooks does the math to help you set money aside for worry-free quarterly taxes. No more year-end surprises.

QuickBooks Self Employed puts your business in your pocket.

Take a look

Sponsored Content: This post is sponsored content and the placement has been paid for or contains affiliate links. For full information, see our terms of use